At Forbes, Ralph Benko challenges Paul Krugman on the gold standard.

Wednesday, June 6, 2012

Monday round up: Kudlow on the jobs report; Benko on Krugman and gold; Tamny on Social Security.

At Forbes, Ralph Benko challenges Paul Krugman on the gold standard.

Wednesday, February 29, 2012

Wednesday summary: Lindsey defends the wealthy; Domitrovic pans Geithner's corporate tax reform advocacy; Ron Paul grills Bernanke.

In The WSJ, Larry Lindsey rebuts Tim Geithner’s claim that the wealthy should pay more taxes for the privilege of living in America:

If you go further back to the pre-Reagan days, when the top tax rate was 70%, the story becomes even more dramatic. Under the four presidents of that era, the income share of the top 5% was 16.8% and their share of the income tax was 36%. In other words, the share of income received by the top 5% has risen 28% and their share of income taxes has risen 64%.

Stated differently, based on the data provided by the Census Bureau and the Internal Revenue Service, the relative tax burden of the top 5% of American earners compared with the remaining 95% has grown from roughly three-to-one prior to 1980 to almost six-to-one today.At Forbes, Brian Domitrovic notes the half-heartedness of Tim Geithner’s corporate tax reform plan.

In Congress, US Rep. Ron Paul (TX) grills Ben Bernanke on the true inflation rate:

From Alhambra Partners, Joe Calhoun sees inflation undermining the recovery.

At The American, James Pethokoukis introduces the Krugman Curve to compete with the Laffer Curve.

On Zero Hedge, Tyler Durden confirms Iran’s move to accept gold in place of dollars for oil.

The Huffington Post reports the poor struggling with rising food prices.

At RCP, Debra Saunders notes Newt Gingrich’s low gas price advocacy.

On TGSN, Ralph Benko recounts creation of the First Bank of the US.

At Grant’s Interest Rate Observer, James Grant suggests the price of gold for convertibility should be $2,500 (h/t: TGSN).

On The Kudlow Report, former Fed Governor Kevin Warsh critiques Fed policy:

From The American, James Pethokoukis defends the Reagan economic miracle.

In US News, Jeff Bell advocates social conservatism.

At Forbes, Steve Forbes predicts war with Iran.

Wednesday, October 13, 2010

Tuesday round up.

On Forbes, John Tamny argues the economy would do fine without the Federal Reserve.

At Zero Hedge, Tyler Durden scolds a former Fed member (currently at the Peterson Institute for International Economics) for recommending the U.S. government sell its gold.

On The Kudlow Report, Larry analyzes the market’s support for looser money:

Investor’s Business Daily reports 56 percent of poll respondents favor keeping all tax cuts in place.

On Jon Stewart (third segment), House GOP Deputy Leader Eric Cantor says Washington has ignored jobs and the economy. Stewart describes the agenda as “freedom and liberty, blah blah blah blah blah.” Cantor suggests Republicans got fired in 2006 because government got too big. No mention of sound money.

At Asia Times, David Goldman doubts Republican electoral gains will help the economy much.

On Forbes, Steve Forbes analyzes Albania’s economic success.

In The Washington Times, Richard Rahn dissects Australia’s winning economic formula.

At CNBC, Keynesian Stephen Roach makes a good point on the dangers of destabilizing China’s financial sector via “a sharp, ridiculously irresponsible increase in the renminbi.” He suggests a more constructive approach is to increase Chinese consumption while increasing U.S. savings and exports:

Last year, Reuven Brenner and David Goldman made a similar argument, built on a formal dollar/yuan link:

Currency policy is the key to opening the world to American exports. What seem like minor errors in Western monetary policy have devastating effects on developing economies. The large industrial economies are like oceangoing vessels designed to withstand typhoons; ten-meter waves may roll them but will not sink them. Not so for the fragile craft in their wake. As former Federal Reserve chairman Paul Volcker once observed, the industrial nations' deep financial markets allow participants to hedge against large shifts in currency parities. Not so for the shallow, inefficient financial markets of developing nations, in which the vast majority of firms do not qualify as derivative counterparties, and the yield curve is not liquid past the two-year mark….

China, in particular, is the natural fulcrum for America's proper economic policy. China's requirements for infrastructure and capital equipment are enormous: Two-thirds of its 1.3 billion people still live in conditions of extreme backwardness. But rather than invest in its own interior, China has diverted its savings to securities in Western currencies as a rainy-day hedge against potential political and economic disruption. America should help China stabilize its currency by a solemn and formal agreement to link the renminbi to the dollar; China in turn should make its currency convertible and open its capital market to American institutions. Other countries may wish to participate in this arrangement; with the world's two largest and most dynamic economies as an anchor, a Sino-American currency agreement would quickly become the point of orientation for the rest of Asia and eventually for other countries.

China's demand for savings, to be sure, stems in part from the one-child policy, which requires Chinese to provide for their retirement with financial assets rather than offspring. But a good deal of Chinese savings is precautionary. With a nonconvertible currency and limited outlets for investment, Chinese are apt to exaggerate their rainy-day savings.

In effect, China needs to reduce its saving rate drastically while America increases hers. Why wouldn't just letting China's currency be convertible on its own, without coordinating with the United States, be part of the solution, as some propose?

The simple answer is that China's capital markets--and, by extension, its political system--are still too fragile to withstand the tsunami-sized capital flows caused by the dollar's instability. Dollar devaluation sends capital rushing into China, distorting asset prices. By contrast, a repetition of the global liquidity crisis that followed last year's failure of Lehman Brothers could provoke massive capital flows out of China, in a repeat of the 1997 Asian crisis. As long as the United States subjects its currency to extreme volatility, China cannot take the risk of making its own currency convertible.

The WSJ editorializes in support of immigration visas for entrepreneurs.

Hawaiian Libertarian offers a good list of historical quotations on the evil of fiat currency.

Thursday, September 30, 2010

Wednesday items.

At Zero Hedge, Tyler Durden lashes the “House of Idiot Representatives.”

At Café Hayek, Don Boudreaux comments here, here, and here.

On The Kudlow Report, former GW Bush advisor Glenn Hubbard and China basher Peter Navarro discuss the need to improve U.S. exports through a lower dollar relative to the yuan:

At Smart Money, Don Luskin worries the China tariffs could trigger a trade war on par with Smoot-Hawley.

From 1999, Jude Wanniski argues the Smoot-Hawley tariff caused the Great Depression.

At The Financial Post, Alan Reynolds responds to income inequality claims:

At NRO, Larry Kudlow critiques the Fed’s monetarist policy.

On Asia Times, David Goldman suggests China’s slow accumulation of gold will help keep U.S. interest rates low.

At The WSJ, Stephen Moore examines the middle-class impact of expected tax increases.

At the National Center for Policy Analysis, Bob McTeer reports a recent Art Laffer comment:

I was on a program recently with Arthur Laffer, who said some things about the Laffer Curve that I wasn’t fully aware of. There was no handout, but, as I recall, he said that careful examination of IRS tax records indicates that below the highest income levels there is no Laffer-Curve effect i.e., marginal tax-rate reductions at those levels would not fully pay for themselves. On the other hand, at the highest income level, there is a strong Laffer-Curve effect, since “the rich” can afford accountants and tax lawyers to avoid or defer taxes.Also at The Journal, Moore suggests the current Congress is responsible for rising deficits.

In Australia, Steve Forbes advocates a flat tax or reduction of the top tax rate.

UK Telegraph columnist Ambrose Evans-Pritchard regrets supporting the Fed’s monetary expansion.

Monday, September 27, 2010

Weekend round up.

The LA Times’ Tom Petruno suggests Congress’s stance on China, plus Federal Reserve policy, is driving the dollar down.

On The Kudlow Report, Peter Schiff debates rising gold:

In a poll by Macleans magazine, Robert Mundell loses to Blackberry creator Mike Lazaridis as Canada’s greatest innovator.

At Zero Hedge, Tyler Durden analyzes the national debt.

Also on Kudlow, Stephen Moore discusses the coming election:

Wednesday, September 1, 2010

Wednesday round up.

Winning the original analysis of the week prize, Paul Kix suggests a stronger Iraqi dinar enabled the surge's success (H/T to Vlad Signorelli at Bretton Woods Research).

At New World Economics, Nathan Lewis discusses The Fourth Turning which suggests the U.S. is in a 20-year "winter" phase.

Steve Forbes interviews Mark Cuban on entrepreneurship.

At Business Insider, Henry Blodget reports lower income tax rates haven't lead to higher savings or investment. The analysis omits what savings and investment would have looked like after the Great Inflation's tax bracket creep without the Reagan tax rate cuts. Also excluded is the impact of capital gains tax rates: higher in 1986, lower in 1996. A third factor is dollar direction: falling during the late 1970s; 2001-2008 similarly corresponds with a falling dollar.

Don Boudreaux rebuts the recurring myth that World War II was a successful example of Keynesian stimulus.

Economics of Contempt lists prominent economic commentators -- many of whom are supply-siders -- who denied a housing bubble was forming.

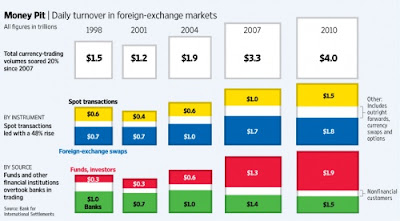

At Zero Hedge, Tyler Durden notes that the volatile currency market is now at $4 trillion per day, dwarfing equities and Treasuries.

Former Bush speechwriter Michael Gerson provides a demand-side analysis of the tax debate.

Politifake.org offers an Art Laffer motivational poster.