Winning the original analysis of the week prize, Paul Kix suggests a stronger Iraqi dinar enabled the surge's success (H/T to Vlad Signorelli at Bretton Woods Research).

At New World Economics, Nathan Lewis discusses The Fourth Turning which suggests the U.S. is in a 20-year "winter" phase.

Steve Forbes interviews Mark Cuban on entrepreneurship.

At Business Insider, Henry Blodget reports lower income tax rates haven't lead to higher savings or investment. The analysis omits what savings and investment would have looked like after the Great Inflation's tax bracket creep without the Reagan tax rate cuts. Also excluded is the impact of capital gains tax rates: higher in 1986, lower in 1996. A third factor is dollar direction: falling during the late 1970s; 2001-2008 similarly corresponds with a falling dollar.

Don Boudreaux rebuts the recurring myth that World War II was a successful example of Keynesian stimulus.

Economics of Contempt lists prominent economic commentators -- many of whom are supply-siders -- who denied a housing bubble was forming.

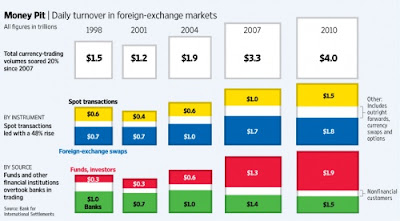

At Zero Hedge, Tyler Durden notes that the volatile currency market is now at $4 trillion per day, dwarfing equities and Treasuries.

Former Bush speechwriter Michael Gerson provides a demand-side analysis of the tax debate.

Politifake.org offers an Art Laffer motivational poster.

No comments:

Post a Comment